Thesis: Allison Davis

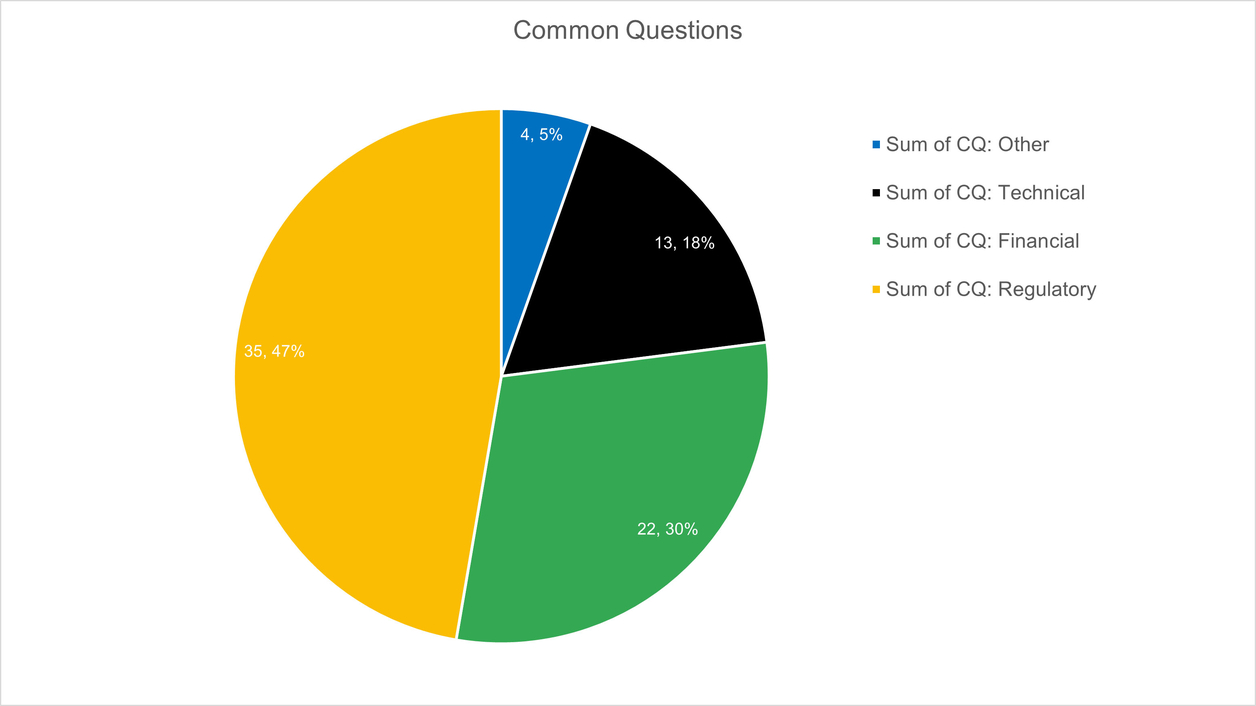

In the U.S. the federal, state, and local governments have initiated various regulations and incentives to encourage and implement historic preservation. Yet preservation at the local level holds the greatest regulatory strengths and plays the largest role with regard to private property and private funding sources. Although federal incentives, especially the Rehabilitation Tax Credit, are available only to income-producing properties, many states now offer tax credits to include owner-occupied properties. Local governments, however, have struggled to find the right balance of “sticks” and “carrots” to manage owner-occupied historic properties. Most literature focuses on financial or regulatory incentives, and economic studies have focused on their financial success. However, a more holistic study of how and why these incentives work is rare.

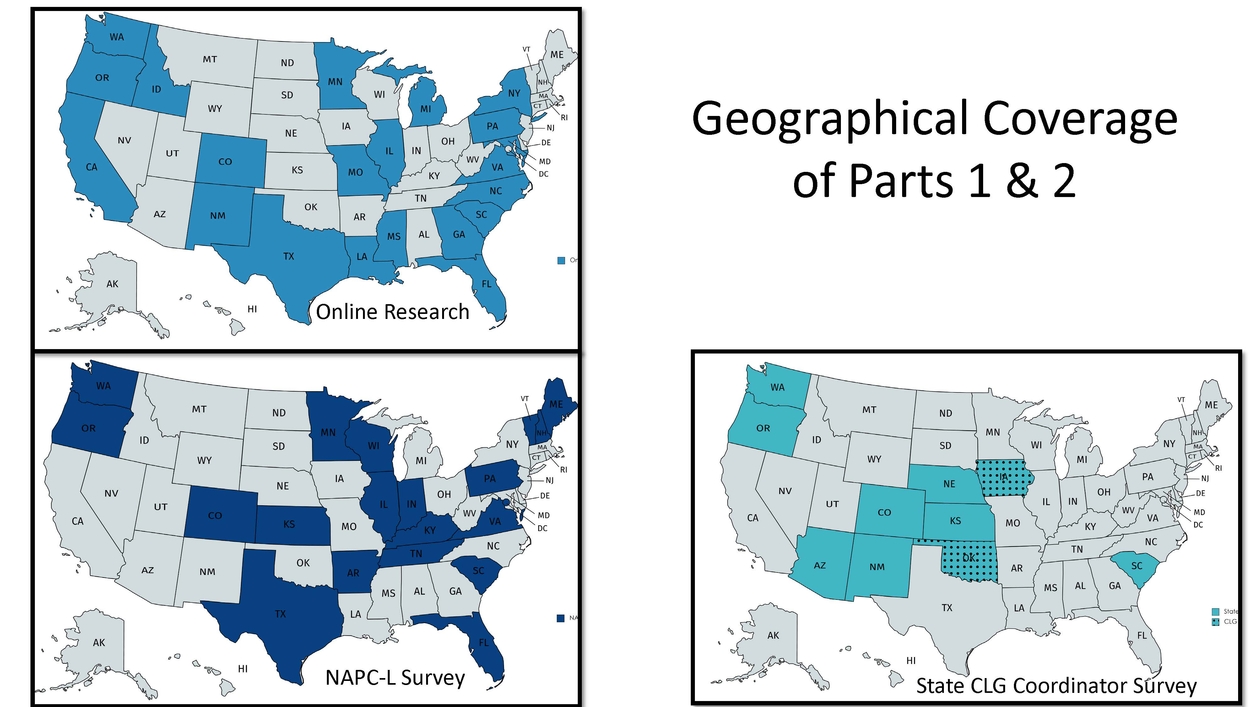

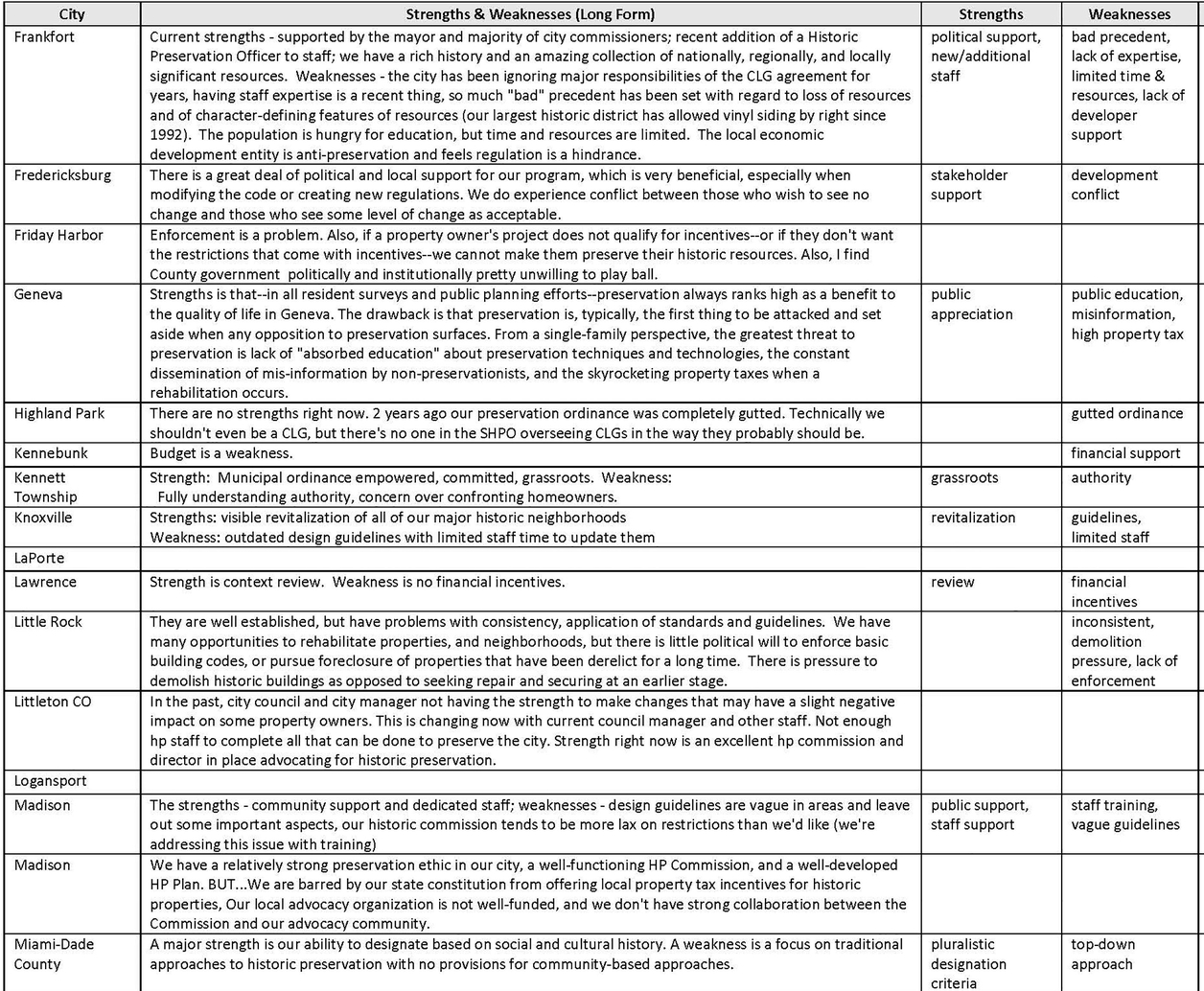

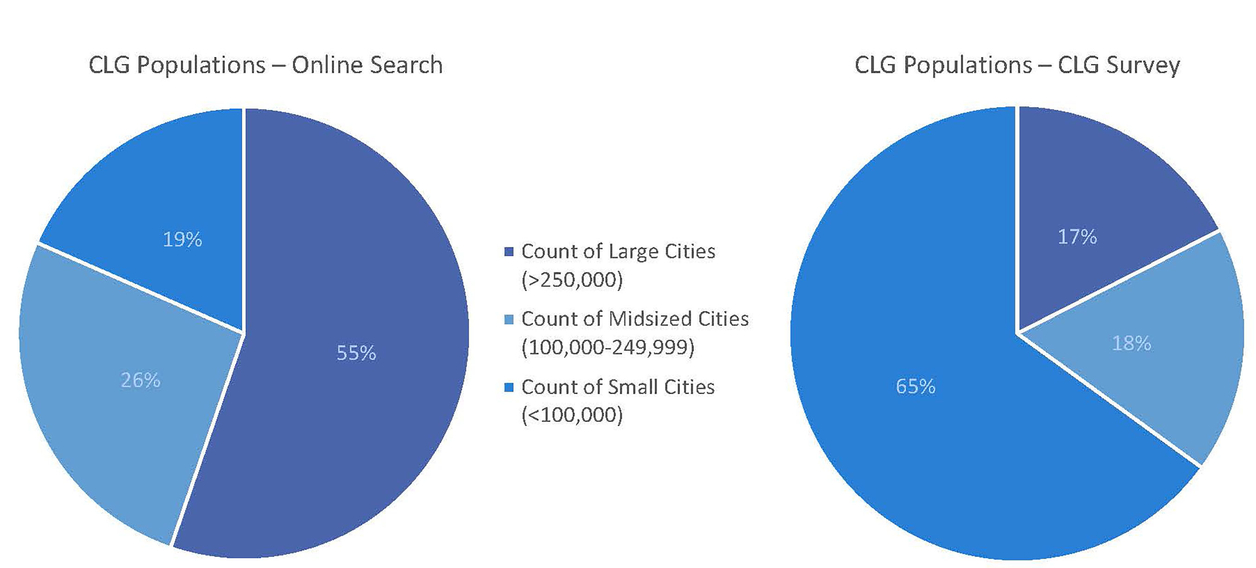

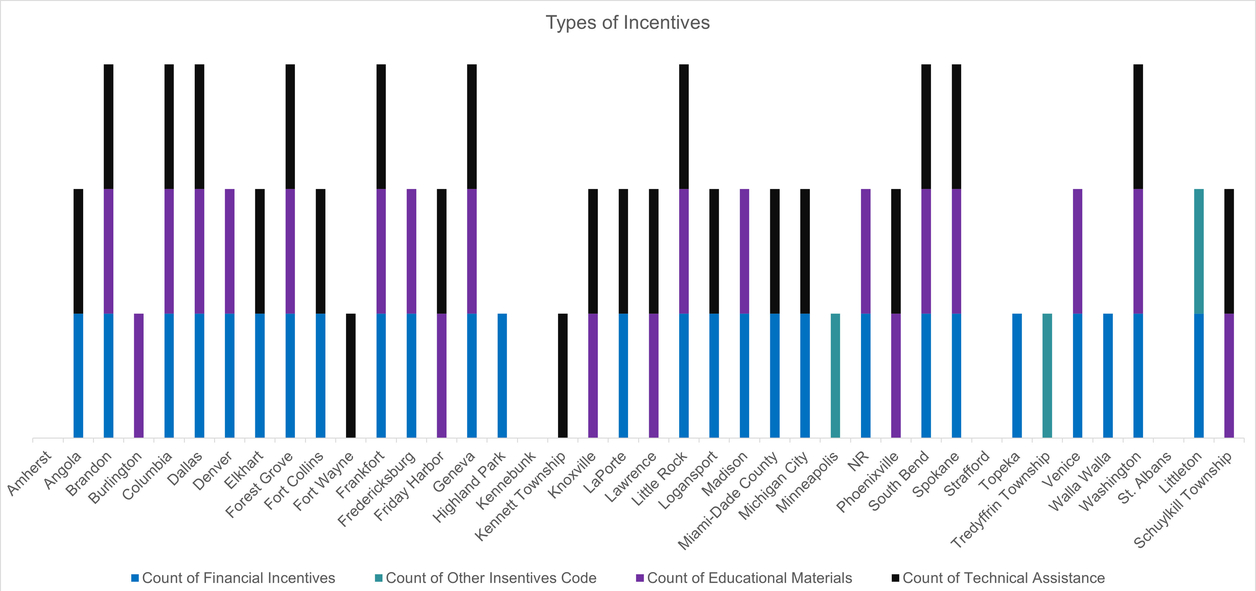

This thesis explores incentive programs Certified Local Governments have devised to mitigate the “stick” directed towards owners of historic houses. This thesis took a three-part approach to examine incentive programs: (1) online research of CLGs to identify criteria to categorize broadly used or unique incentives; (2) surveys to the National Alliance of Preservation Commissions and CLG State Coordinators to gather first-hand knowledge about local incentive programs; and (3) interviews to gather deeper insight from specific survey responses about incentives, strategies, or composition of CLG programs. The results of the research reveal concerns but also the strengths of the CLGs who responded to the surveys. After discussing the biggest hurdles facing CLGs now, this thesis recommends strategies supported in the literature and through success stories to implement successful incentive programs.