Thesis: Nicole Felicetti

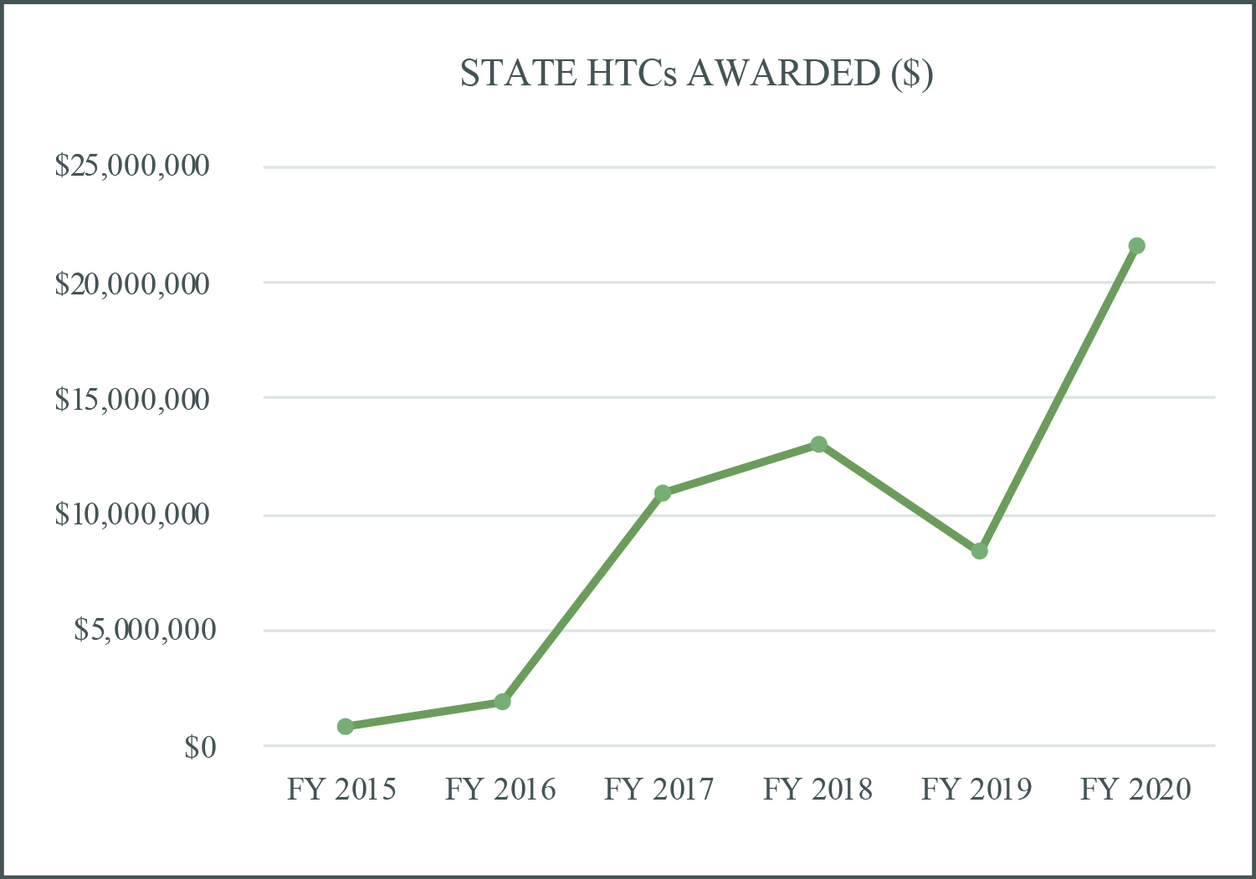

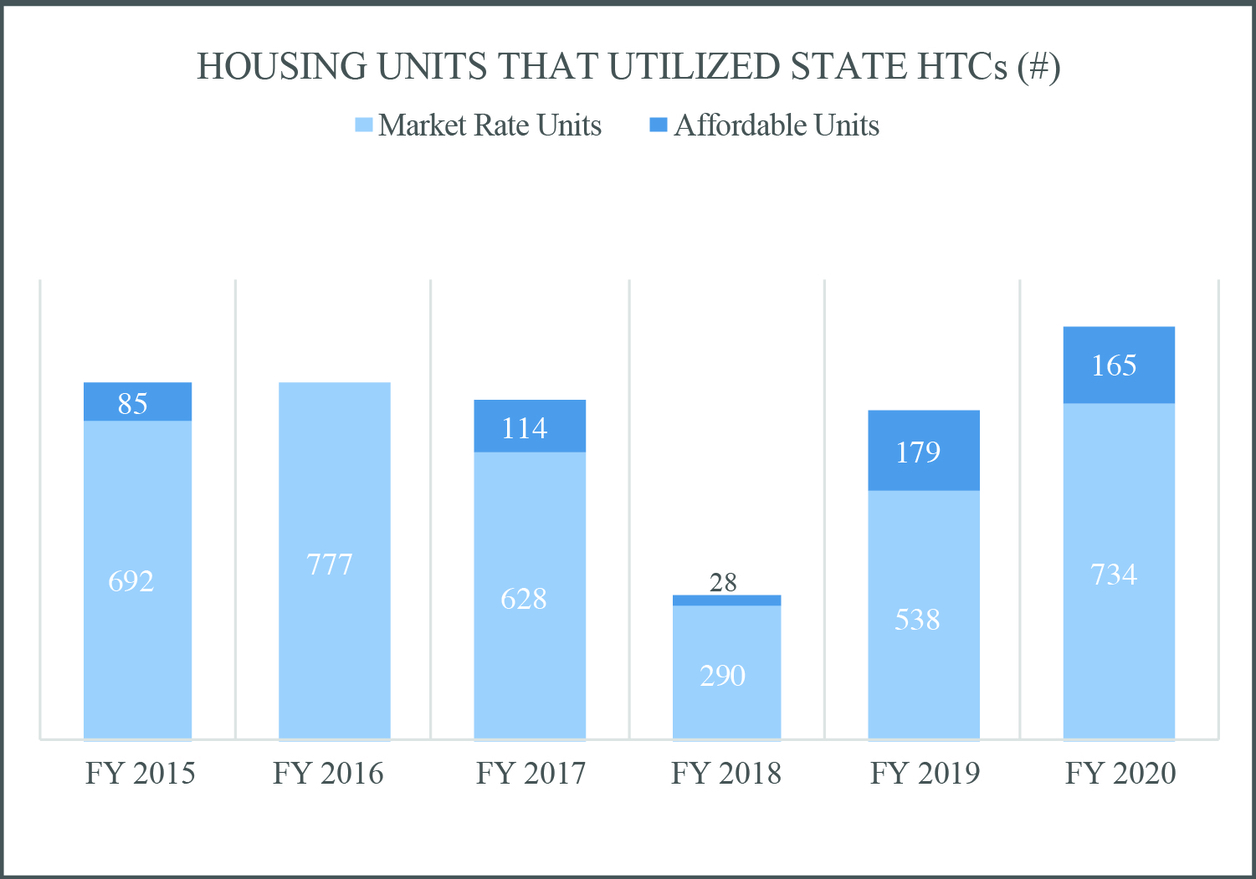

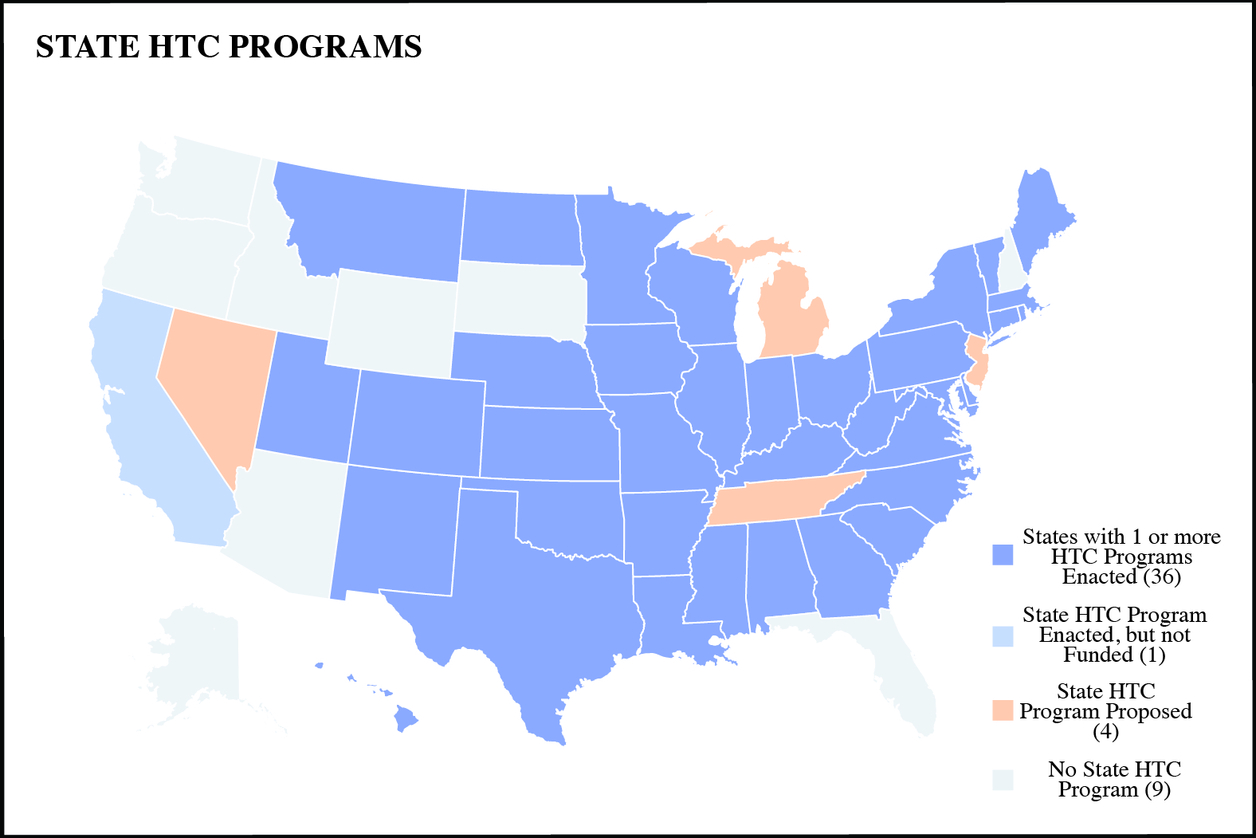

Historic tax credit (HTC) programs and similar financial incentives have historically filled a critical financing gap in the rehabilitation of historic buildings, effectively providing capital to projects that otherwise would not be economically feasible and generating development in small or economically disadvantaged communities. Specifically, state HTC programs parallel to the federal historic tax credit program have leveraged additional private and local investment and encouraged the stewardship and rehabilitation of historic buildings. State HTC programs also catalyze several benefits throughout local communities, including creating and preserving affordable housing units. As cities seek ways to mitigate a growing number of affordable housing problems and reinvest in their historic built environment, financial incentives at the state level figure have an important, if not critical, role. Therefore, this thesis cross-analyzes all state historic tax credit programs throughout the United States to determine the most effective attributes for generating rehabilitation projects with affordable housing outcomes. This thesis identifies how state tax credit programs can fill a critical gap in subsidizing affordable housing through the historic built environment via a comparative analysis of the regulatory structure of HTC programs and a qualitative synthesis of program data from recent fiscal years. The analysis relies on a national survey of existing enabling legislation across each state, state HTC coordinator correspondences, and case studies to determine the enabling and constraining attributes of state HTC programs as determinants of affordable housing rehabilitations and preservation.