Thesis: Maggie Sollmann

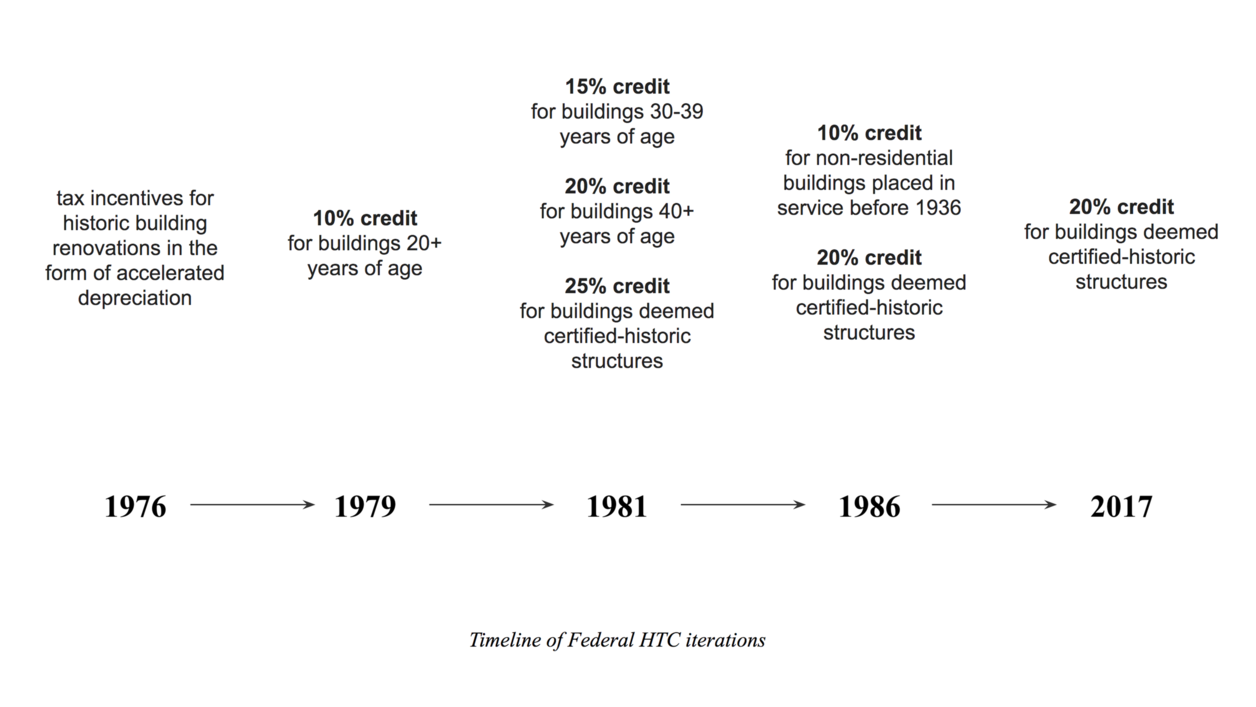

Expanding the eligibility requirements of the Federal Historic Tax Credit, an evidence-base narrative

The Federal Historic Tax Credit (HTC) is one of the strongest tools in preservation to ensure the retention of our historic existing historic built environment. The term historic, however, has only been used to encapsulate a finite group of buildings and districts of certified-significance—those of which have obtained National Register status. While a building may be requested to be added to the register by the State Historic Preservation Office, it is a counterintuitive endeavor that: can lead to a false end when a building’s history or physical entity does not meet the necessary criteria for significance; and dilutes the purpose of the National Register to be used as an inventory of nationally-significant assets. This eligibility requirement greatly reduces the HTC’s ability to positively impact neighborhoods currently seeking relief from their underutilized existing building stock.

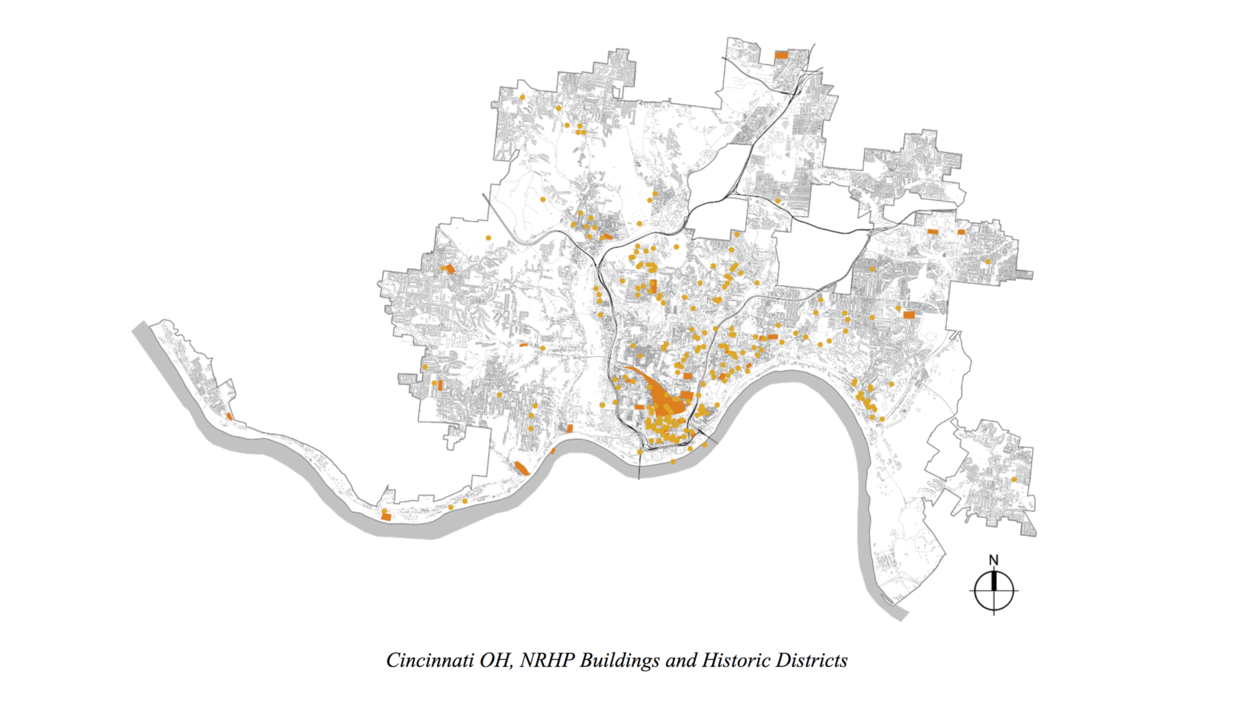

By developing an evidence-based narrative through historical analysis of the HTC program and qualitative research into the extant building stock of Cincinnati OH, this thesis seeks to critique the current architecture of the Federal Historic Tax Credit program and its ability to provide more equitable and sustainable redevelopment of both certified-historic and older building stock in our cities.