June 23, 2017

Stuart Weitzman School of Design

102 Meyerson Hall

210 South 34th Street

Philadelphia, PA 19104

Get the latest Weitzman news in your Inbox

Media Contact

Michael Grant

mrgrant@design.upenn.edu

215.898.2539

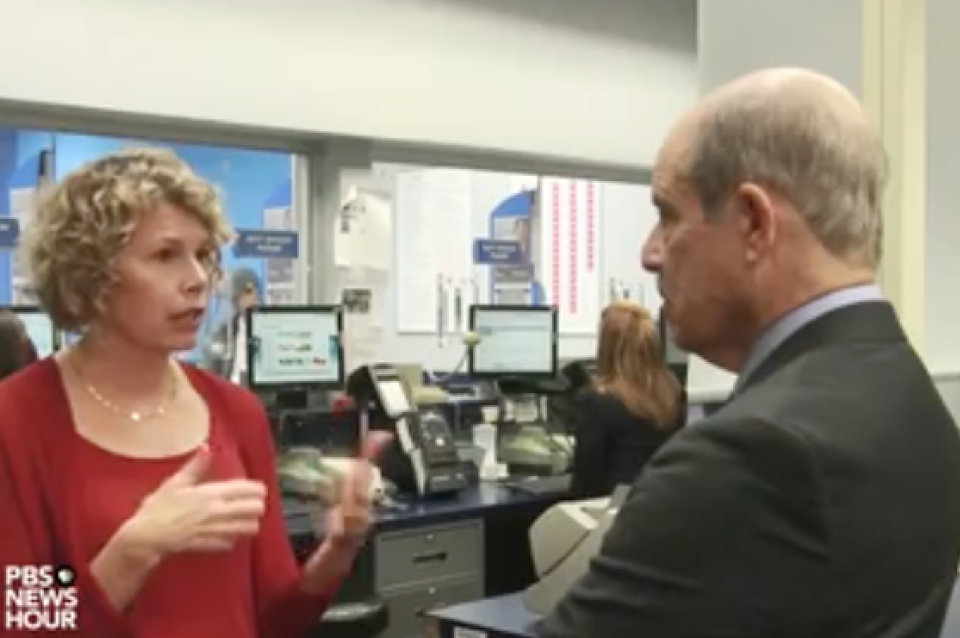

Lisa Servon, Professor and Chair of the Department of City and Regional Planning, was interviewed on the PBS News Hour about the surprising logic behind the use of check cashers and payday loans. Servon shares her experiences working at various check-cashing business in researching her new book, The Unbanking of America: How the New Middle Class Survives:

“It didn’t make sense to me that people would be using a service like this in increasing numbers if it was so bad for them. I had done work in low-income neighborhoods for 20 years, and I knew that people who don’t have very much money know where every penny goes. So, that’s when I scratched my head and I realized there’s got to be more to the story.

One of the things that we do here is to take money off of people’s EBT cards. That’s electronics benefit transfer, what you get. It’s kind of the equivalent of welfare these days. Right?

And we give you how much you want from that, minus a $2 fee. One day, a woman came in and she wanted — she said had $10 on her card. So, I ran the transaction and I gave her $8. And after she left, I just was scratching my head and thinking, wow, she just paid me 20 percent of what was available to her. Jackie says, well, ATMs don’t give you $8 or $13 or $28. They give you multiples of $20, maybe $10, if you’re lucky, right? So, suddenly, something that seems illogical makes sense, because you realize that she needed that $8. She needed every dollar that she could get access to, and it was worth it to her to spend $2 in order to get it.

Time and again, working at the window, I was able to really see those things, sometimes ask questions, then really see like, oh, this is logical, actually. I would probably do the same thing if I was in that situation.”

Expand Image

Expand Image